Courtesy : marketsandmarkets.com

Green Data Center Market by Component (Solutions [Power, IT, Cooling] and Services [Design and Consulting, Maintenance and Support, Installation and Deployment]), Data Center Size (Small and Mid-sized, Large), Vertical, and Region -Global Forecast to 2026

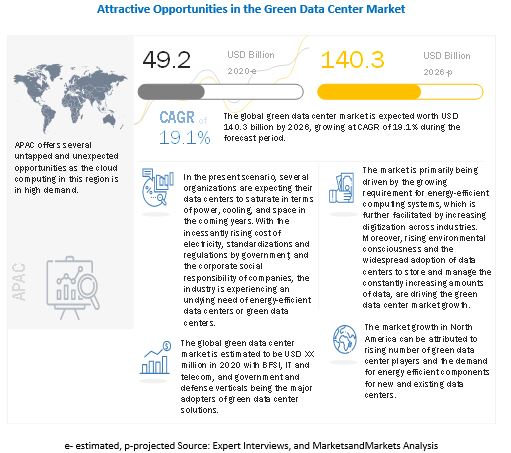

The green data center market size is expected to grow from USD 49.2 billion in 2020 to USD 140.3 billion by 2026, at a Compound Annual Growth Rate (CAGR) of 19.1% during the forecast period. The green data center market is gaining traction in various regions and has caught the eye of various organizations for deploying green data center solutions. In the present scenario, organizations have started taking green initiatives for their regular IT operations to save their money, making green data center as most popular initiatives. In an all-inclusive manner, a green data center comprises energy-efficient components, such as UPS, servers, and cooling systems.

To know about the assumptions considered for the study, download the pdf brochure

COVID-19 impact on global Green data center market

As the world moves through the COVID-19 pandemic, organizations across industries are accelerating their digital transformations and looking toward technology to help them adapt to a new normal where disruption could be around every corner. The hyperscalers are constantly fulfilling the spike in the cloud services due to work-from-home economy. According to United Nations – International Labour Organization (UN-ILO) estimates, four-fifths i.e. 81% of the world’s population has been subject to full or partial workplace closures. This is putting companies like Google, Microsoft, and AWS and other hyperscalers in a commanding position. Cloud share of enterprise spending has been on an upward trajectory for many years, but the rate of acceleration is set to spike. Whether it’s public, private, or hybrid cloud, the tech giants are dominating the market. However, the hyperscalers have always enhanced on improving data center efficiency. A recent study, by a reputed US university, revealed that the amount of energy used by data centers increased by only 6% between 2010 and 2018 in spite of a 550% growth in the volume of computing. Hyperscale data centers take the credit for this. Hence, it can be implied that as most of the hyperscalers are catering to the sudden spike of cloud services, they are expected to use energy efficient data center solutions like power, IT and cooling.

However, lockdowns have tanked economies round the world. The COVID-19 is wreaking the IT supply chain. Data centers are part of an ecosystem, supporting customers which pay for their services. Some industries like entertainment, transport and hospitality have been hit harder than others, and some data centers will suffer an impact. Physically moving servers, closing buildings and opening new data center spaces, is massively complicated due to the COVID-19 norms. In an Uptime Institute survey of over 200 critical IT/facility infrastructure operators around the world, a third of operators said a reduced level of IT infrastructure operations staff due to COVID-19 poses the single biggest risk to operations. There are many project delays as the supply chain has taken a hit due to COVID-19 pandemic. Due to supply chain disruption of hardware components from major IT vendors, the market is expected to see a slow growth in 2020. However, once the virus is contained, the market will enter its recovery phase and grow at a normal CAGR.

Green data center Market Dynamics

Driver: Major vendors offering ECO modes in UPS to drive the adoption of green data centers

The ECO mode is also known as ‘Active Standby’ or ‘Economy’, is the most energy-efficient UPS operating mode. This mode is capable of providing exceptional efficiency up to 99%. The ECO mode sees the bypass line (raw mains supply) to power the load, with the inverter powered but remaining “off” as long as the mainline is in tolerance. The main benefit of ECO mode is increased efficiency of the bypass line, which typically runs at 98-99% as compared to the standard online UPS efficiency of 93-97%. That difference of anywhere between 2-6% has the potential to deliver significant savings. Consider a large-scale facility, where even a 1% improvement in efficiency could equate to tens or even hundreds of thousands of dollars a year in lower energy costs. There are two types of ECO modes available in the market, these include traditional UPS Eco Mode and the advanced Eco Mode. The advanced ECO mode is preferred due to its quick supply of clean energy to the data center infrastructure. Such developments in UPS from leading vendors are driving the adoption of green data centers from various industry verticals.

Restraint: High investments in existing infrastructure

The initial investment in building an energy-efficient green data center is comparatively higher than the cost of building a traditional data center. Companies are reluctant to invest such huge amounts in green data centers, when they already have existing traditional data centers, despite the fact that the Total Cost of Ownership (TCO) for green data centers is better, and savings in long-term will pay back the initial investment, higher capital investment is considered as a crucial restraint in the green data center market. Moreover, if the price of electricity continues to grow at the same pace, the initial RoI can be obtained earlier than the expected time.

Opportunities: Emergence of AI in cooling and power technologies

AI and ML are expected to play a huge role in the future to efficiently power and cool data centers across the world. For instance, Google has been working with British AI company DeepMind to develop an AI algorithm that will help decrease the power needed for cooling purposes without requiring expensive relocations of data centers. The AI approaches the cooling power problem from the perspective of optimizing effective power management. Leveraging deep learning techniques, the AI breaks down vast quantities of historical data from various aspects of operating the data center and utilizes predictive modeling to gauge the effect on energy usage. Google and DeepMind’s algorithm, AlphaGo, applies the trial-and-error reinforcement learning model to figure out the best framework of cooling infrastructure, such as fans and ventilation, which would most effectively lower energy consumption. Recommendations from AlphaGo were then applied at Google’s data centers, leading to a 40% reduction in power costs related to the cooling systems. Similarly, IBM has been approached by Nlyte to leverage its IBM Watson for integrating the same with one of its products designed for data centers. The solution aims at collecting diverse data from cooling and power systems installed at several data centers. IBM Watson is assigned the responsibility of analyzing the data to build a predictive model for knowing exactly which processors and systems would be breaking down on account of getting hot. Historical information is used in combination with complex algorithms for thermal optimization to reduce energy consumption. By controlling temperatures at the proper level, one can improve power efficiency by as much as 40%. Lack of information or access to the tools needed to boost data center’s energy efficiency is the root cause of the underutilization of cooling efficiency. The adoption of AI by companies that range from startups to huge organizations, including Google or Siemens, underlines a novel approach to improve the efficiency of data centers. AI has demonstrated that data centers can significantly improve power consumption to reduce costs. The potential for the use of AI, and other emerging technologies such as ML and deep learning is a huge opportunity in the green data center market. These technologies will soon be operating entire data centers and will also help improve security parameters and reduce events of power outages by taking proactive steps.

Challenge: Challenges with existing infrastructure compatibility

Data centers have been prevalent for a long across various industry verticals, and their existence is not relatively new. They have evolved from giant supercomputers to current blade servers. Numerous companies already have data centers, and many of them do not intend to replace their data center facilities completely with green data centers. These companies are unenthusiastic toward investing a huge amount in rebuilding their data centers from scratch. Here, the challenge of green solutions with the operating equipment and solutions of existing data centers is a serious subject, and companies have concerns regarding the compatibility. So, in the green data center market space, the incompatibility of energy-efficient green solutions with existing data center equipment is an important challenge for vendors in the green data center space. However, many companies wish to add/replace certain components to make their existing data centers more efficient These companies desire to have compatible green solutions, so that they can achieve higher profitability and lower their operational expenses. Hence, many vendors are tackling this challenge and providing components, such as green servers, cooling, and power infrastructure, which can be modified as per the existing data center structure and deployed easily.

Media and entertainment vertical to grow at the highest CAGR during the forecast period

Media and entertainment companies are creating an incredible amount of content with escalating resolution. The challenge is to manage this vast amount of unstructured data in a way that can be easily scaled up and be readily accessible across the media chain. Thus, they use up a huge amount of compute storage and other services that require a high amount of power. Due to the sudden increase in the user-base of Over The Top (OTT) platforms, such as Netflix and Amazon Prime, the need for energy-efficient data centers is crucial to serving its customers. Content delivery is highly dependent on the performance of the infrastructure on which the content delivery solutions run. With the help of green data center solutions, media companies are providing globally accessible content repositories that can be accessed anywhere, anytime through desktops and smart devices, such as tablets and laptops.

Large data centers segment to hold a larger market size during the forecast period

Large data centers range above 25,000 square feet of area and consist of high-density server racks. They offer better ceiling services installation and smooth flow of operations on the production floor. Large data centers use high-energy efficient Computer Room Air Handler (CRAH) and Precision Air Handling Unit (PAHU) machines. They also include better liquid cooling that optimizes efficiency and minimize losses. The power utilization by this type of large data center is high as compared to that of mid-size and enterprise data centers. This is due to the presence of greater data center infrastructure and more complex networking, server, storage, and other equipment, which requires efficient green data center solutions and services. Large enterprises with a high density of cloud computing systems use large data centers. The green data center systems, which offer efficient power flow to both private and hybrid cloud, use large data centers as the storage system. It reduces CAPEX and OPEX and offers data protection. Increased adoption of large data centers among large enterprises is expected to boost the green data center market globally in the coming years.

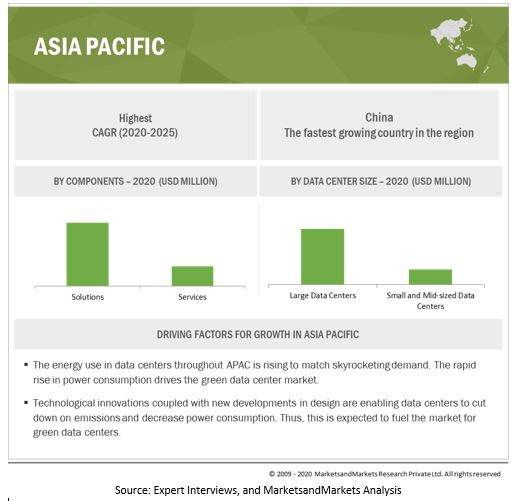

Asia Pacific to grow the highest during the forecast period

The global Green data center market by region covers 5 major geographic regions, namely, North America, Asia Pacific (APAC), Europe, Middle East and Africa (MEA), and Latin America. Asia Pacific is expected to grow the highest owing to the rising internet and smart phone penetration.

Key Market Players

The Green data center market comprises major solution providers, such as Schneider Electric (France), Vertiv (US), Hewlett Packard Enterprise (US), Green Revolution Cooling (US), Midas Green Technologies (US), Delta Electronics (Taiwan), Rittal (Germany), Eaton (Ireland), Cisco (US), Nortek Air Solutions (US), Dell Technologies (US), Asetek (Denmark), Airedale (UK),Lenovo (Hong Kong), Fujitsu (Japan), Cyber Power Systems (US), Super Micro (US), Tripp Lite (US), Inspur (China), CDP Energy (US), Bxterra Power Technology (US), ZutaCore(US), Submer (Spain), DCX The Liquid Cooling Company (Poland), and Liqit.io (Ukrain). These players adopt new product developments as their key growth strategy.

The study includes an in-depth competitive analysis of these key players in the Green data center market with their company profiles, recent developments, and key market strategies.

Get online access to the report on the World’s First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

REQUEST SAMPLE Click on image to enlarge

Scope of the Report

| Report Metric | Details |

| Market size available for years | 2016–2026 |

| Base year considered | 2019 |

| Forecast period | 2020–2026 |

| Forecast units | Million (USD) |

| Segments covered | Component, data center size, vertical and regions. |

| Geographies covered | North America, APAC, Europe, Latin America, and MEA |

| Companies covered | Schneider Electric (France), Vertiv (US), Hewlett Packard Enterprise (US), Green Revolution Cooling (US), Midas Green Technologies (US), Delta Electronics (Taiwan), Rittal (Germany), Eaton (Ireland), Cisco (US), Nortek Air Solutions (US), Dell Technologies (US), Asetek (Denmark), Airedale (UK),Lenovo (Hong Kong), Fujitsu (Japan), Cyber Power Systems (US), Super Micro (US), Tripp Lite (US), Inspur (China), CDP Energy (US), Bxterra Power Technology (US), ZutaCore(US), Submer (Spain), DCX The Liquid Cooling Company (Poland), and Liqit.io (Ukrain) |

This research report categorizes the Green data center market based on components, data center size, vertical, and region.

Based on components, the Green data center market has been segmented as follows:

- Solutions

- Cooling

- Power

- IT

- Services

- Design and Consulting

- Installation and Deployment

- Maintenance and Support

Based on data center size, the Green data center market has been segmented as follows:

- Small and Medium-sized data centers

- Large data centers

Based on verticals, the Green data center market has been segmented as follows:

- BFSI

- IT and Telecom

- Media and Entertainment

- Healthcare

- Government and Defense

- Retail

- Manufacturing

- Others (energy, research and academia, and transportation and logistics)

Based on regions, the Green data center market has been segmented as follows:

- North America

- US

- Canada

- Europe

- UK

- Germany

- France

- Rest of Europe

- APAC

- China

- Japan

- Australia and New Zealand

- Rest of APAC

- MEA

- KSA (Kingdom of Saudi Arabia)

- United Arab Emirates (UAE)

- South Africa

- Rest of MEA

- Latin America

- Brazil

- Mexico

- Rest of Latin America

Recent Developments

- In January 2020, At the World Economic Forum Annual Meeting, an alliance of academia and industry representatives announced the Swiss Data Center Efficiency Label with the initial goal to decarbonize data centers in Switzerland and significantly reduce their overall energy consumption. Initiated by the industry association digital switzerland and HPE, the alliance has founded the Swiss Datacenter Efficiency Association (SDEA), which will own the assessment and award process for the label. The initiative is supported by the Swiss Federal Office of Energy through the program Swiss Energy.

- In September 2019, Eaton and Amdocs collaborated to create efficient data centers. Amdocs worked with Eaton and Carter Sullivan to transform its London data center and satellite offices into a modern, purpose-built infrastructure, resulting in increased efficiencies and cost-savings.

- In October 2020, GRC partnered with Total Data Centre Solutions (TDCS), a leading provider of mission-critical and innovative infrastructure solutions for Data Centers throughout Europe and the Nordic region focused on carbon reduction and energy efficiency. Through the partnership, TDCS will act as the agent for GRC in Europe, selling GRC’s ICEraQ Micro-Modular, Rack-Based Immersion-Cooling Systems and ICEtank Modular, Containerized data centers to clients primarily in the UK, the Nordic region, Germany, and Luxembourg. Additionally, this new partnership now enables GRC to engage and support European data center customers with a local European presence.